Bleak future for Sasol.

The 5th of March may be a Rubicon for Sasol investors as Moody downgraded Sasol to junk status.

The press release from Moody’s states that Moody’s “has today downgraded Sasol Limited’s (Sasol) long-term rating to Ba1 from Baa3 and its short-term rating to Not Prime from P-3. The long-term national scale rating has been downgraded to Aa2.za from Aa1.za while the short-term national scale rating has been affirmed at P-1.za. The rating outlook has been changed to stable from negative.” As well as “Moody’s has withdrawn the Baa3 issuer rating and assigned a Ba1 corporate family rating (CFR) to Sasol, in line with the rating agency’s policy for non-financial corporates with non-investment grade ratings downgraded from investment-grade ratings.”

However, the rating outlook has improved from negative to stable.

The root cause of Sasol’s problems is the overruns on the budget for its Lake Charles Chemical Project (LCCP) which is expected to cost $12.8bn compared to an original budget of $8.9bn.

Governance failures and inadequate project oversight led to escalated costs not being identified and reported in a timely manner on LCCP. The cost overruns at LCCP has burdened Sasol with high financial leverage and has weighed on the company’s credit profile over the years.

Moody’s further said in their statement that, “The decision to downgrade the ratings to Ba1 reflects Moody’s view that Sasol’s financial leverage will remain elevated over the next two years and that the pace of deleveraging is vulnerable to event risks and challenging market conditions globally and domestically, as demonstrated over time by the company’s downward revisions of EBITDA forecast on the Lake Charles Chemicals Project (LCCP). The rating agency estimates that free cash flows over the same period will not materially reduce the ZAR138 billion debt stock, majority of which was accumulated as a result of the LCCP.”

“Sasol’s liquidity is adequate with available group cash balance of ZAR10.4 billion as at 31 December 2019 along with forecasted FFO generation of ZAR32 billion in calendar year 2020 being sufficient to fund working capital needs and sustaining capex of approximately ZAR24 billion,” Moody’s statement continued, “ An additional ZAR4 billion is needed to complete LCCP while of the ZAR18.4 billion of short term debt, ZAR14 billion is related to the unsecured syndicated loan facility which has a final maturity in April 2021.”

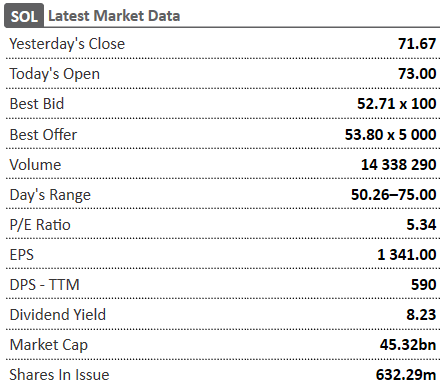

Fin24 reported on the drop in Sasol share prices. “Sasol’s share price reached R68 earlier on Tuesday, after trading at around R480 as recently as in April last year. After falling 47% on Monday in reaction to an oil price crash, its share price was down another 8% by late Tuesday afternoon. It was last trading at around R53.85. Less than a year ago it was trading above R470.The market now values Sasol at around R47 billion. The company has a debt burden of more than R120 billion, and investors are worried that it may be forced to issue more shares to raise cash.”

Sasol has now lost more than 65% since the week started, the most among the 1,401 members of the MSCI Emerging Markets Index, which is down 5.6%. The latest slump has dragged the stock to levels last seen in early 2001.

Source: sashares.co.za 08H00 11/3/2020

Brent crude oil prices crashed 31 percent to $36.30 a barrel this week, the lowest level since 1991, amid an oil bloodbath prompted by Saudi Arabia’s decision to slash its oil prices over the weekend by about 10 percent after Russia walked away from the negotiating table.

Russia on Friday refused to join Opec’s production cut as the coronavirus continues to ravage the global economy and, with it, demand for oil, pitting Russia against Saudi Arabia.

“This further compounds Sasol’s problem as Sasol assumed that oil prices will be staying a $50 to $70 a barrel. This was used to calculate their outlook projections, Brent, unfortunately, dropped to as low as $31.02 on Monday,” Reported Bloomberg.

This does not spell anything good for Sasol nor does it for investors. The Lake Charles Chemicals Project (LCCP) will haunt the company for a very long time still. Or so it appears.

It has been a week of steep drops for some emerging-market stocks, but Sasol has out-plunged its peers, battered by the crash in oil prices and concern among investors of a potential looming rights offer as it grapples with a debt burden of about $8 billion.

After a 47% crash on Monday, Sasol lost more on Tuesday and then fell another 25% on Wednesday afternoon. It was last trading at R53.85 – less than a year ago it was above R470.

Sasol has now lost more than 65% since the week started, the most among the 1,401 members of the MSCI Emerging Markets Index, which is down 5.6%. The latest slump has dragged the stock to levels last seen in early 2001.